trust capital gains tax rate australia

CGT also applies to other assets including investment property but not your residence managed funds etc acquired after 19. The ATO has recently released two draft tax determinations TD 2016D4 and TD 2016D5.

Do Retirees Pay Capital Gains Tax In Australia Wealthvisory

The tax-free allowance for trusts is.

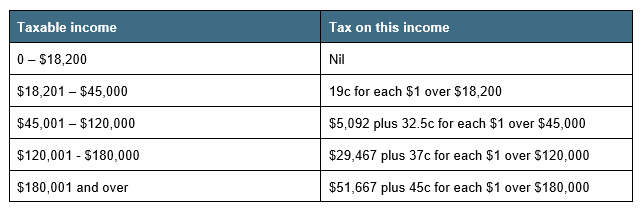

. By comparison a single investor pays 0 on capital gains if their taxable income is. This amount is taxed at that individuals marginal tax rate. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains.

Few structures are as widely used but as little understood as trusts especially when it comes to the potential tax. Sec 99 Minors income distributions to minors from deceased estates are treated as excepted. Irrevocable trusts are very different from revocable trusts in the way they are taxed.

For example this may occur if the trustee. Namely the 50 CGT discount. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. Including a 10000 capital gain in income would cost 3700. If there is trust income to which no beneficiary is entitled then the trustee must pay tax on that income.

An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. The income tax rates on income earned from assets in a testamentary trust are the same as personal income tax rates.

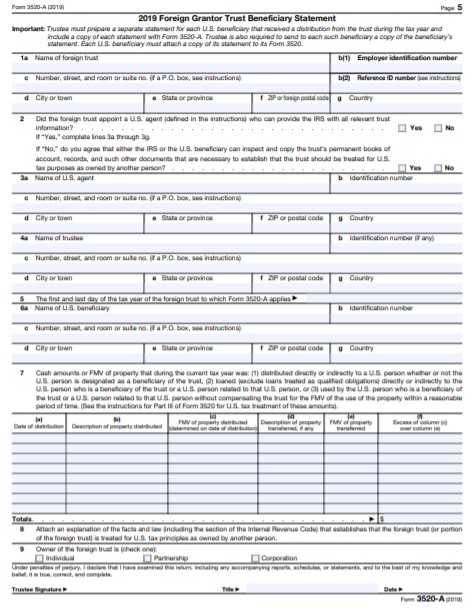

To get a copy of the form you. 45 x R64 00000. We expect these will underpin further audit activity around capital distributions from foreign trusts.

Broadly you calculate CGT on the difference between the asset sale price and the price paid. 2022 Long-Term Capital Gains Trust Tax Rates. The tax on the capital gain would be 37.

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. Will Wizard Australia Pty. The tax on the capital gain would be 37.

By HR Block 3 min read. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. What is the capital gains tax rate on a trust.

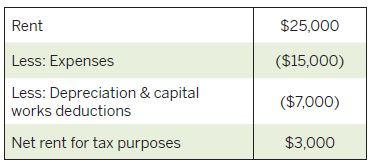

Understanding Tax Implications of Using Trusts. How to get a copy of the form. 40 of R160 00000 is included in the taxable income of the individual.

As part of the trusts net income or net loss the trust has to. One of the tax advantages of a family trust is related to Capital Gains Tax CGT. In the 4th and subsequent tax years a progressive tax scale applies as below.

Tax Paid by Trustees. What is the capital gains tax rate on a trust. The marginal tax rates for individuals.

The result of this is that the New Zealand resident beneficiaries are subject to Australian tax at non-resident tax rates between 325 and 45 on capital gains derived from New Zealand. Check if your assets are subject to CGT exempt or pre-date CGT. If the trust disposes of all assets it is generally subject to capital gains tax CGT.

One of the tax advantages of a family trust is related to Capital Gains Tax CGT. What is the tax rate on capital gains in a trust. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets.

Capital gains tax CGT schedule 2022. However once the general 50 discount is deducted the taxpayer. Use the Capital gains tax CGT schedule 2022 with the company trust or fund tax return.

The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations.

End Of Financial Year Guide 2021 Lexology

The Pros And Cons Of A Family Trust For Property Investing Property Tax Specialist

A Brief History Of Australia S Tax System Treasury Gov Au

Does New Zealand Have A Capital Gains Tax Cgt Wk Advisors And Accountants

Taxation In Australia Wikipedia

What Are The Tax Rates On Testamentary Trusts Online Will Australia

Testamentary Trusts Katrina Jacobs Estate Law

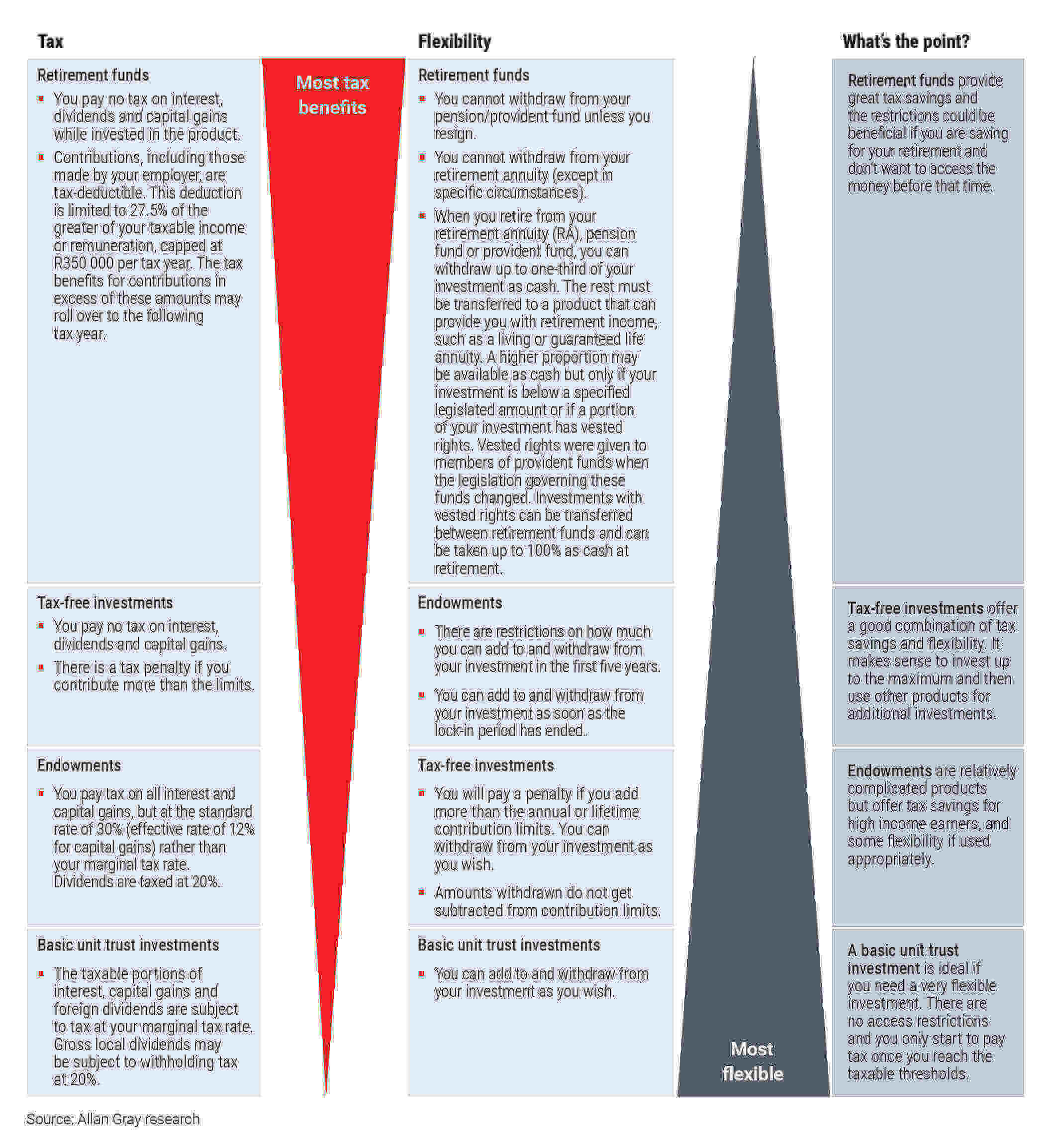

Allan Gray Part 2 How Can I Earn Higher Investment Returns And Pay Less Tax

What Are The Tax Advantages Of A Trust Legalvision

An Update On The Use Of A Corporate Beneficiary Cooper Partners

A Dummies Guide To Unit Trusts Andreyev Lawyers

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Htj Tax

The Tax Issues Of Using A Trust To Own Your Investment Property Yip

Guide To Capital Gains Tax Cgt Realestate Com Au

Capital Gains Tax Cgt Calculator For Australian Investors

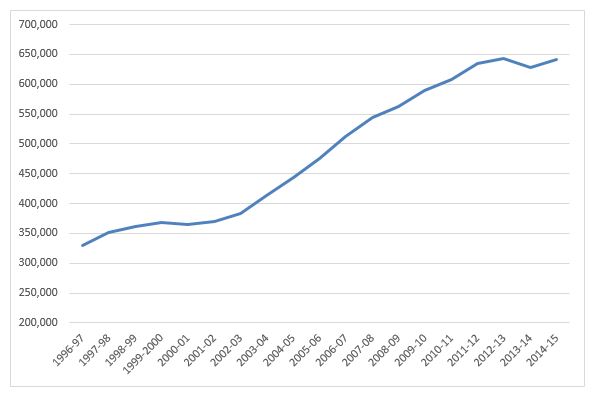

Bracket Creep And Its Fiscal Impact Parliament Of Australia

Income Tax Implications For Capital Gains Tax Alert November 2021 Deloitte New Zealand