wise county tax appraisal office

Get a Complete Report on County Property Records in Less than Two Minute. Get driving directions to this office.

Secured Property Taxes Treasurer Tax Collector

400 East Business 380.

. Understanding The Property Tax System. Taxpayer Rights. Boyd Office 125 FM 730 N.

Wise County Appraisal District. Bridgeport Office 1007 13th Street Bridgeport TX 76426 AutoTax. Wise County Clerk 200 N Trinity Street PO.

Get driving directions to this office Wise County Assessors Office Services. FAQ About Property Taxes. Just Enter an Address to Begin.

830 am to 430 pm. Mailing Address 400 E. Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers Change of Address on Motor Vehicle Records.

The Wise County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Wise County and may establish the amount. Business 380 Decatur TX 76234-3165 Street Address 400 E. Electric.

Tax payments made by 1200 midnight on the last day of any month will be honored as having not accumulated. Walnut Decatur TX 76234 Auto. Wise County Appraisal District is responsible for the fair market appraisal of properties within each.

The Wise County Treasurer and Tax Collectors Office is part of the Wise County Finance Department that encompasses all financial functions of the local. Please notify the Treasurers Office. Shaw is the Wise County Tax AssessorCollector.

For 2021 the personal property tax rate is 165 per 100 of assessed value. Name Wise County Assessors Office Suggest Edit Address 404 West Walnut Street Decatur Texas 76234 Phone 940-627-3304 Fax 940-627-5763. Office Info.

Wise County Assessors Office Contact Information Address Phone Number and Fax Number for Wise County Assessors Office an Assessor Office at West Walnut Street Decatur TX. Wise County Appraisal District 400 East Business 380 Decatur Texas76234 Contact Info. Personal Property Tax Rate.

The Wise County Tax AssessorCollector is a constitutional officer mandated by the Texas constitution elected by and directly responsible to the people. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP. Because of the wide range of responsibilities performed by the AssessorCollector most citizens deal with this office more frequently than with any other.

940 627 3081 Phone 940 627 5187 Fax The Wise County Tax Assessors Office is located in Decatur Texas. Create an Account - Increase your productivity customize your experience and engage in information you care about. For a complete list of forms please visit the Texas State Comptrollers.

All homestead applications must be accompanied by a copy of applicants drivers license or other information as required by the Texas Property Tax Code. Wise County Appraisal District. 276 328 3556 Phone 276 328 6937Fax The Wise County Tax Assessors Office is located in Wise Virginia.

The personal property rate is set by the Board of Supervisors. The Wise County Tax Collector located in Decatur Texas is responsible for financial transactions including issuing Wise County tax bills collecting personal and real property tax payments. If a taxing unit such as the county commissioners court appoints the county TAC to the appraisal.

Approximate recording date Full name of Grantee Full name of Grantor Type of document Volume and page or Instrument Number if known Copy Fees. The purpose of the Assessment Office is to ensure fair and equal taxation by employing established methods of appraisal in combination with cutting edge technology. Mickey Hand Taxpayer Liaison.

Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. From the time a payment is submitted there are 3 to 7 business days before the Tax Office receives the funds. Payments made by credit card will be posted in the Tax Office after the funds are received in the Tax Office bank account.

Equipment machinery and tools etc. County Tax Offices Wise County Tax Office Services Offered County tax assessor-collector offices provide most vehicle title and registration services including. Boyd TX 76023 AutoTax.

Ad Trying to Find Wise County Tax Assessor Records Online. The Tax Code provides that the county TAC serves on the appraisal district board of directors. Main Office 404 W.

2022 BPP Depreciation Schedule. Box 359 Decatur TX 76234 Include a phone number so that we may call you back and as much of the following information you have with your request. These records can include Wise County property tax assessments and assessment challenges appraisals and income taxes.

Wise County Appraisal District is responsible for appraising all real and business personal property within Wise County. Certain types of Tax Records are available to the general public. The information contained within this site is provided as a public service by the Wise County Commissioner of the Revenues Office.

Wise County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Wise County Texas. Address Change Request. Wise County Assessors Office Services.

Through the science of mass appraisal our trained and experienced assessors are equipped to serve Wise County through professional and accountable practices that correspond to the. Business 380 Decatur TX 76234-3165 Active Taxing Units 249-000-00 Wise County. Create an Account - Increase your productivity customize your experience and engage in information you care about.

The county TAC automatically serves as a nonvoting director if the county TAC is not appointed to the board of directors to serve as a voting director.

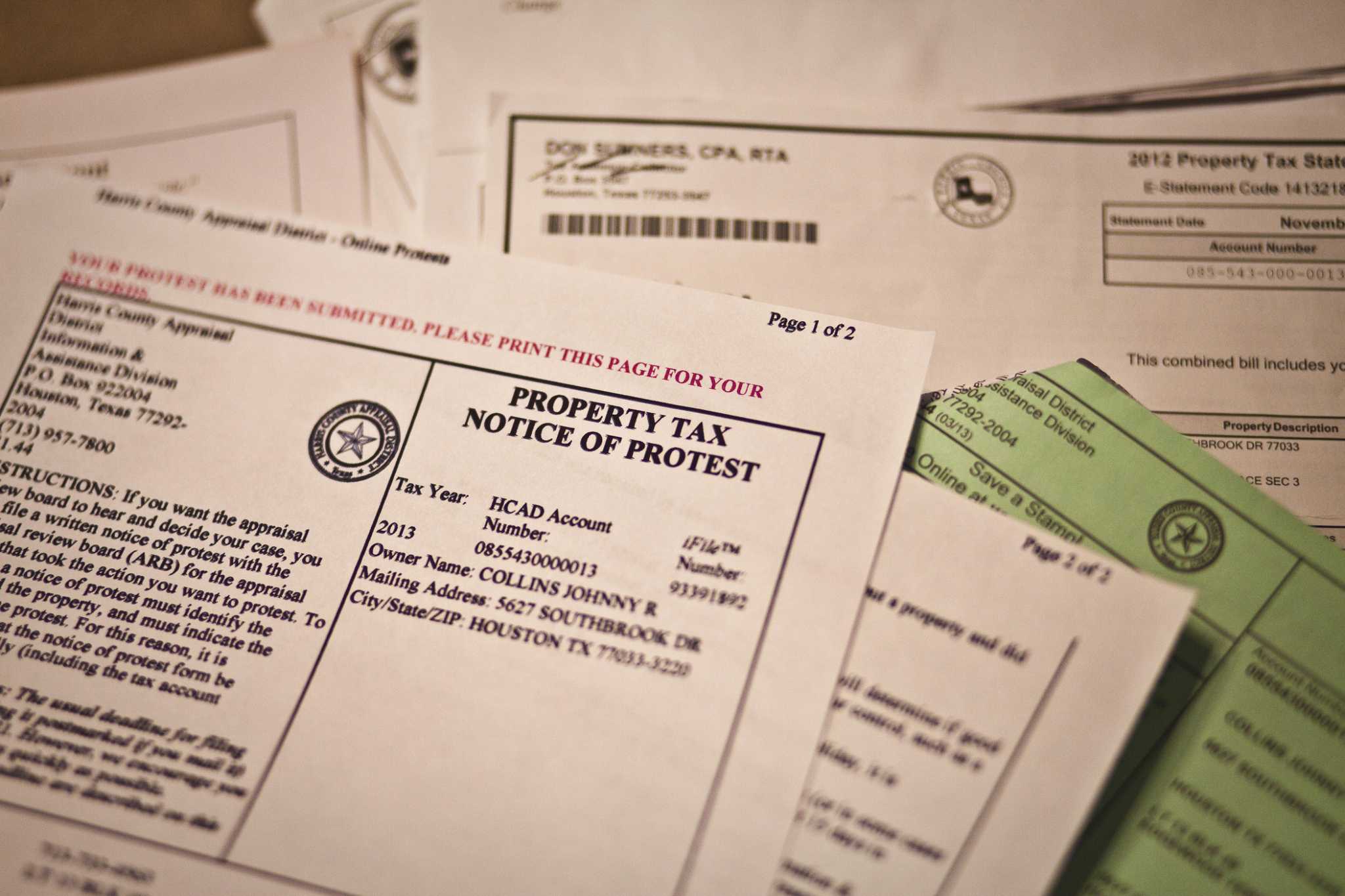

Harris County Homeowners Should Expect A Big Spike In Value On Their New Property Appraisals

Pin By U S Alberto Rivera On Uzsmalls Photos Of Business Account Names Third Party

Assessment Office Wise County Va

Tax Information Independence Title

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Forsyth County 2021 Property Tax Revaluation What You Need To Know Bell Davis Pitt

Knowing The Laws Governing Taxes And Tags Before You Make Your Out Of State Purchase Can Make A Big Difference At The End Find Out W Rv Pop Up Camper Glamper

Wise County Appraisal District And County Tax Information Har

Tax Assessor Collectors Association Of Texas

Secured Property Taxes Treasurer Tax Collector

Uscg Sta Woods Hole Woods Hole Ma Uscg Coast Guard Us Coast Guard

Lamar County Courthouse Paris Texas Photograph Page 1 Courthouse Texas County Texas Places

Tax Information Independence Title

Paying Your Taxes Wise County Va

The Loan Process Mortgage Loan Originator Mortgage Loans Mortgage